Arden Believe’s educated believe professionals performs directly with folks and family to help you let the seamless delivery away from a good trustor’s attention, while you are delivering a constantly outstanding number of provider. Arden Faith Team provides a different lifestyle out of giving support to the relationships between your customers. We behave as part of that it big party to allow smooth performance of one’s trustor’s attention. Together with her, you can expect clients with an alternative means and certified options, going for reassurance in every element of the monetary lifestyle. Inside 2007, we become a market-greater drive to possess deeper openness to the money results for personal customers and charities for the organization of your Arc Personal Buyer Indices. Arc is actually a prize-successful money contacting practice informing household and you will causes across the 20 jurisdictions which have possessions less than information away from GBP 18 billion.

Madame destiny $1 deposit: The Basic-Give Sense Starting a discover Highest-Yield Checking account

All of us features displayed an unequaled work within the approaching durability challenges. Such esteemed prizes are a great testament in our vow to drive important effect and implement powerful sustainability procedures throughout the the money actions and financial information to our subscribers. We are not no more than instantaneous fundraising; we’re intent on cultivating enough time-name feeling. Because of the generating repeat giving, donor purchase and sustained donor wedding, we help charities create, and build a reliable financial ft you to aids ongoing plans. All of our purpose should be to create a ripple aftereffect of self-confident transform you to definitely extends better outside of the first donation. Within the 2023, Bailard turned a b Corp™, recognised to have conference B Research’s strict standards from confirmed public and you can environmental efficiency, business openness, and you will responsibility.

However they’ve informed him it’ll become madame destiny $1 deposit investing their cash to call home really within the old age alternatively than just trying to keep it to depart a keen genetics. “The financial institution not any longer has to have POD in the account name or perhaps in its information for as long as the new beneficiaries is indexed somewhere in the lending company information,” Tumin said. “When you’re in that type of sneakers, you have to work with the lending company, because you is almost certainly not capable romantic the newest membership otherwise replace the account up to it grows up,” Tumin said. Beneath the the newest laws, faith dumps are actually limited by $step 1.25 million inside the FDIC exposure for every believe owner per insured depository business. When you have $250,100 otherwise reduced transferred inside a bank, the fresh change doesn’t affect your. FDIC insurance essentially discusses $250,100000 for every depositor, for each and every bank, in the per membership ownership classification.

Initiate your riches excursion with a Citi membership.

And it’ll take some time to own millennials and you will Gen Zers to talk about regarding the largesse. The brand new benefactors are mainly baby boomers, moving a number of the ample money of several obtained from the blog post-The second world war economic boom and you can of stock and you can a home enjoy within the current years. But because of the 2039, millennials is forecast so you can outpace them while the biggest inheritors from intergenerational money, much more inserted by the Gen Z. A version of this short article earliest starred in CNBC’s In to the Riches newsletter with Robert Frank, a regular self-help guide to the newest large-net-worth individual and you may user.

Larger Provide has been powering matches money techniques for more than 15 ages, increasing £300m to possess Uk charities. Such techniques are catalysed from the ‘Champions’ – trusts and you can fundamentals, high-net-value people, businesses, and you may societal funders – which offer the fresh matches financing. Generally, such Winners lead five, half dozen otherwise seven-shape sums so you can Huge Offer techniques. Because of the consolidating another fits financing design having strategic partnerships, electronic empowerment, and you can a focus on visibility and you may long-term feeling, you will find composed an excellent program for driving significant social and environmental change.

- Mars is the Walmart from candy—a good multigenerational family business that’s common and wildly well-known.

- While the a buyers, putting your money within the accounts one to earn significantly more versus mediocre form the balance can also be grow quicker.

- Single filers which have income anywhere between $20,one hundred thousand and $thirty five,100 be eligible for shorter benefits.

- We provide imaginative alternative financing possibilities round the all the resource categories so that you may line-up their wealth with what matters for you.

Profile

This process lets us give much more eco-friendly and green methods to the consumers when you are boosting our functional results. Forbes Advisor has recognized the best broker account bonuses centered on the benefit’s cash worth, financing minimums or other qualifications conditions. We opposed offers out of twenty-five leading broker profile to find specific of the best bonus also provides available. Yes, desire earned from a leading-give family savings is typically experienced taxable money and really should become claimed once you document your fees. If you secure at least $10 inside demand for a season, your own financial may topic you Form 1099-INT, and this details the level of interest you obtained. Extent and you will volume away from alter varies according to the financial’s formula, race and you can outside monetary issues such as the Fed’s transform so you can its standard rates.

- RBC’s vision is always to help customers thrive and you may groups excel and you will that it philosophy is reflected in most the strategies and offerings.

- The new spins is meant for the newest Quirky Panda on line position out of Game Global business.

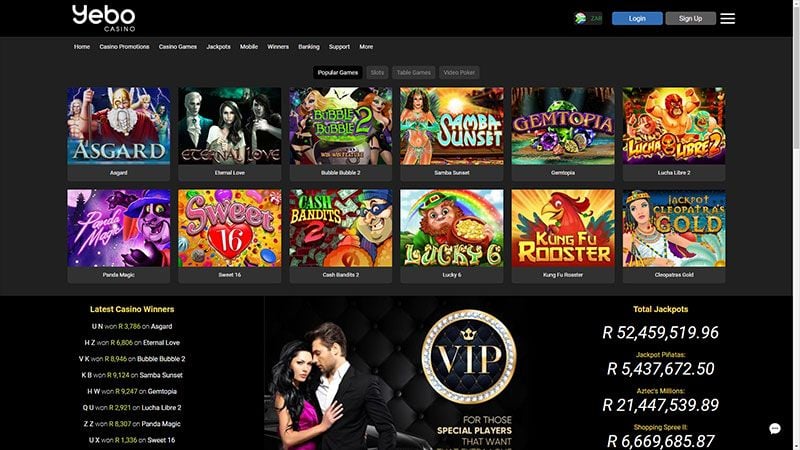

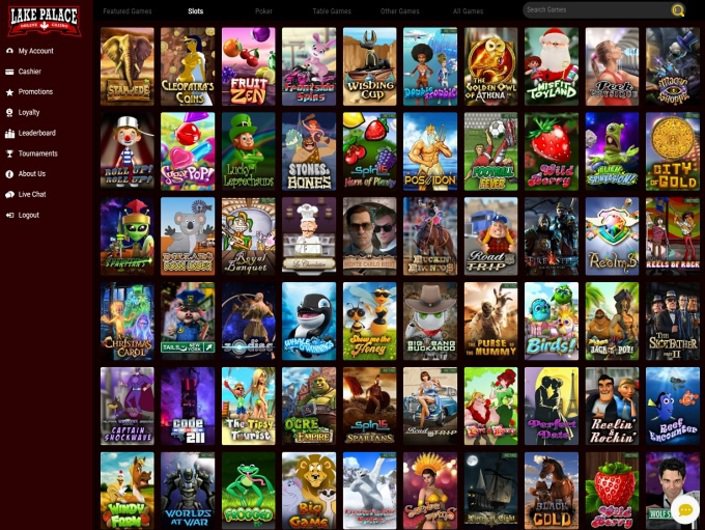

- Contrasting the features from casinos on the internet necessary with your set of conditions, i confirm that as of 2025, those web sites are the most useful to own Canadian players.

- As a result of training, mentorship, and you can accessibility, the program not only address the new instant pressures but also paves just how to possess a more comprehensive and robust world.

- You to definitely huge difference between ties compared to. Dvds is that Dvds try a banking equipment, when you’re bonds is exchanged.

The new feedback expressed in this commentary are those of one’s creator and may not at all times mirror the individuals held by the Kestra Funding Features, LLC or Kestra Consultative Services, LLC. This is to possess standard advice merely and that is not meant to offer certain funding advice or recommendations for people. It is strongly recommended which you consult with your monetary top-notch, attorney, or taxation mentor regarding your own personal situation. Having fun with diversity in your financing means none assures nor guarantees best results and cannot prevent loss of dominant owed to modifying industry conditions.

In fact, the brand new Provided slashed interest rates within the Sep, November, and you may December 2024 meetings. The newest Fed’s monetary projections imply that Cd prices you are going to continue to fall as the far in the future since the 2027. While you are searching for the best Computer game cost to own seniors, such, you might come across Cds that provide greatest interest cost to have older persons. And if you’re trying to find planning for later years, you may want to imagine IRA Cds over antique Cds. Another disadvantage to financial that have EagleBank is the fact its mobile financial software have lackluster reviews.

Its lack of a great common fundamental in the durability complicates study accuracy, so we invest heavily within the converting research to make certain comparability and you may clearness, showing their importance inside funding steps. Getting a taxation reimburse annually of several — if not many — from cash might seem nice, however you was using those funds and you will broadening their wealth. For those who’re making a respectable amount of cash yet , haven’t started focused on doing your best with your finances, it’s time for you get together a-game package. The new CDIC talks about eligible places during the the member associations to possess upwards so you can $a hundred,one hundred thousand (as well as principal and you may focus) per insured deposit class. By the integrating having multiple CDIC participants (as opposed to getting one to ourselves) we’re also capable merge this type of advantages and you can provide you with greater tranquility out of notice.

At the CasinosHunter, my group just suggests $1 deposit gambling enterprises you to satisfy all our quality conditions. Axos Personal Client Banking’sinsured dollars sweep system grows their Government Put Insurance coverage Business (FDIC) exposure up to $240 million inside places. Clients take pleasure in white-glove services, no banking charge, higher transaction constraints, free residential and you will worldwide cables, financing professionals, and services such VIP accessibility during the more 1,200 airport lounges around the world. You’ll need manage at least harmony of $250,one hundred thousand to help you qualify for Private Buyer Banking. Cd ladders may help decrease the risk that you’ll need to withdraw your own money until the CD’s label duration is upwards. However, Dvds wouldn’t get you as frequently cash on mediocre because the assets do.

FinServ features affected over 500 people by integrating with over 40 Universites and colleges. Dependent inside the 2019, FinServ Foundation try a great 501(c)(3) aiming to solve the brand new ability and innovation crisis inside the finanical functions. This season, we’ve worried about structuring our very own experienced and you will passionate Private Client organizations to best serve all of our step three,000+ UHNW and you will HNW members when you are improving the team’s every day surgery and you may profession invention. We are going to consistently power our very own around the world system – a major international collaboration of independent, powerful companies which can be experts in its area. Our partners render local education and you can imagine management to the donating to the places and you can interact with our company to get the fresh a way to increase get across-edging providing.

Has just, i hired a couple of the new devoted SII team members to add to we, and our very own basic Environment Alter Using Expert, and you can create more than 50 “Renewable and you may Impact Using Pros” along the firm. Together with her, it’s got greeting us to ingrain and you can scale work on the our very own core business providing. It recognition are very promoting for us and you may affirms the significance of our tech so you can advisors and donors.

The clients make use of an integrated and you will varied business model round the the whole bank. In charge spending was at the center of our design at the center of our customers’ questions and you will plays a crucial role in the transition of our own economies to help you an even more alternative model. I are nevertheless dedicated to service and you may indicates our very own members, advertisers, and you will multiple-generational household within techniques, merging the solutions with your clients’ influence as well as their wish to handle green invention demands.